If you're in the US, today's the day to file your taxes. Contrary to expectations, speaking with someone from the IRS is pretty helpful! Good luck getting through, however. So, you better hope that you can the IRS has a good search engine to help you find your own answers.

Note: while I work for a search provider, I have no inside information about the IRS's search.

The Search Bar

The first entry point into search that you'll likely encounter is on the homepage.

I think the search bar here is the right level of prominence. Search is not the primary goal of this website, and so it would not make sense to have the search bar be any larger or in a more central location, like you might see on a help desk.

However, I have to mark off points, as there is no inclusion of search suggestions or autocomplete. Search suggestions can help guide searchers and ensure that they are correctly formulating their queries. The lack of feedback here is a negative, especially as queries will likely follow a long-tail distribution, where the majority of search traffic is going to be in a handful of popular queries and the rest are going to be in queries that are seen rather rarely.

Search suggestions can help with both of these, as it will more quickly get searchers to popular results while making sure that long-tail queries are more likely to have a formulation that will show good results.

Query Understanding

And that's bad! Because the ability of the IRS's search engine to understand poorly formed queries is bad.

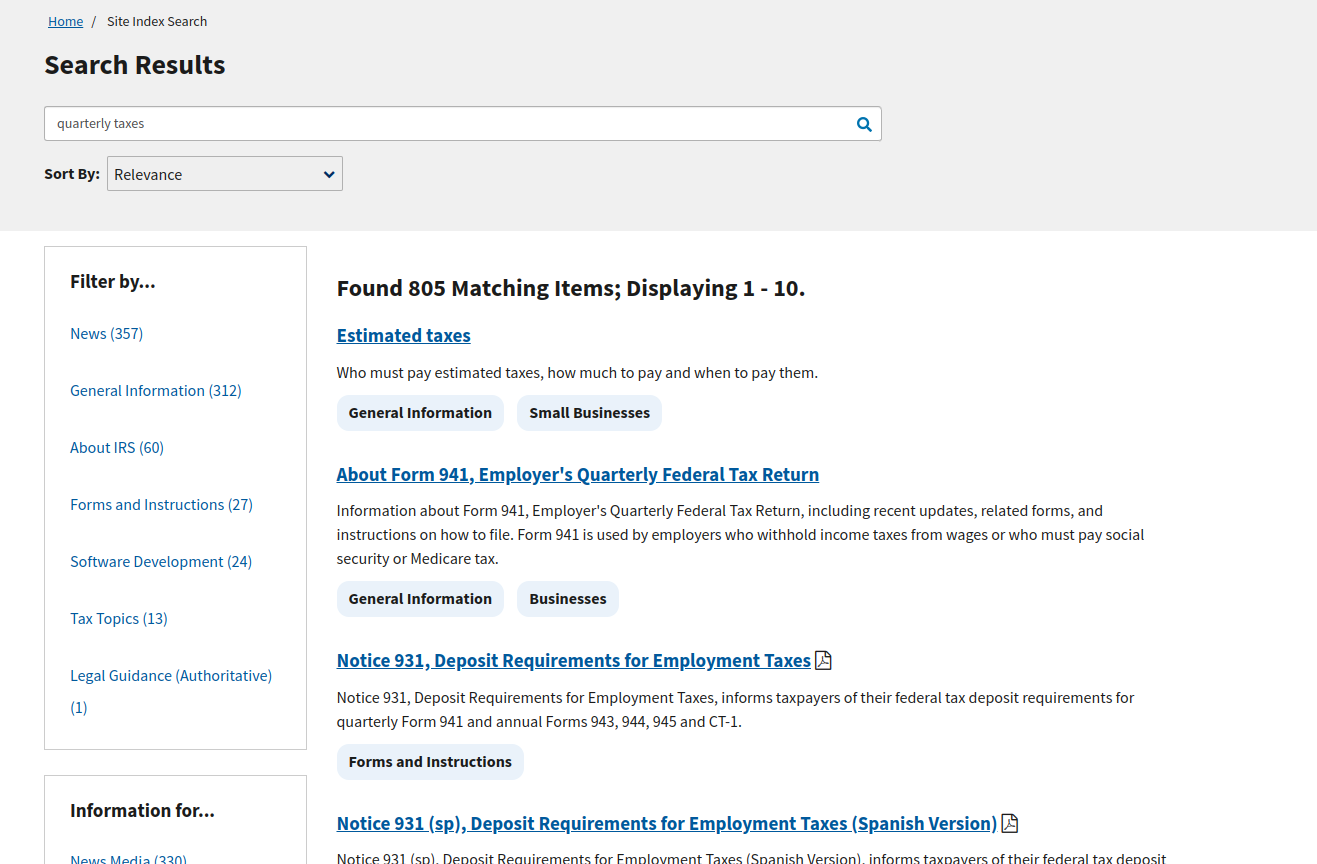

If you don't have taxes taken out of your paycheck (e.g., you're a freelancer), you're supposed to estimate how much you're going to owe and pay it quarterly. Let's see what the query quarterly taxes gives us.

We're doing well so far. The page title is not an exact match, but it's exactly what we want with a query as broad as this one, so I'd have to say this is a success.

Let's instead try a couple of queries with typos. First, qurterly taxes (missing a letter) and then qaurterly taxes (a transposed letter). These are very common mistakes.

Here the search completely falls down, and we don't get any results at all. Small points for providing some "tips" on how to reformulate the query, but we shouldn't get to this point in the first place.

Let's look now at how the search handles slightly different formulations of the same query, looking at non-profits compared to non profits.

The search does better here and returns results for both queries, but it's clear that the search engine takes an overly precise approach to matching results. There's no reason that these two queries should return different results.

Considering the engine's poor handling of typos, we can't expect it to handle queries that describe what the searcher wants, but let's try one anyway. How about we see if we can amend our taxes from the previous year.

I would say, at least we get some results, but with results like these, we're better off getting nothing at all.

Let's go back to a simpler query. I want to find some information about the 1040 Easy form.

Again, I'm not finding what I want, because I didn't know that I should really be searching with the term 1040 EZ.

At least these results are really good! It highlights one of the good things about the IRS search results: the interface itself.

Search Interface

In the 1040 EZ query, there was a call-out at the very top of the results showing a result that is "Recommended by IRS" and that's even better shown for a broader query, 1040.

This result contains not just the recommended result, but related forms as well.

It's too bad that these call-outs aren't more common. They exist for queries like child tax credit and late filing, but not for how to file late. These are time-intensive to make, but the IRS has requested $4 billion for FY25 on "technology and operations support" across 10,282 employees, so I'm sure they can put one person on crafting manual call-outs part time.

Also of note are the filters and the sorting options. Searchers can filter by either category (e.g., News or General Information) or by audience. For sorting, there are options for sorting by "Relevance" or by "Date." Both of these are good, though I would add a filter for year, as well, as some of this information is surely relevant for some years more than others. (It appears that archived pages aren't included in the results, but a page could be not archived, but not relevant for a given tax year.)

All told, the IRS search is not good. It's too bad, because the IRS search should be good as it impacts every adult in the United States and many outside. When you don't, or can't, invest in good human support, good search can offload much of the search volume, but only if people can actually find what they want.

I give the IRS search a 2/5.